how does maine tax retirement income

Is my retirement income taxable to Maine. Maine generally imposes an income tax on all individuals that have Maine-source income.

How To Plan For Taxes In Retirement Goodlife Home Loans

Maine does not tax Social Security income.

. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. The exemption increase will take place starting in January 2021.

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. BUT that 10000 maximum.

Maine allows each of its pensioners to deduct 10000 in pension income. Subtraction from Income You will make a manual entry in tax software for. Maine Military Retired Pay Income Taxes.

Determine the Pension Income Deduction. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt. Depending on your other income you could use the standard deduction to shelter up to 1255025100 withdrawn from a taxable account such as a 401k or IRA every year without.

Thrift Savings Plan TSP does not withhold taxes for state or local income tax but it is reported annually on. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. Ad Its Time For A New Conversation About Your Retirement Priorities.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning. Is my military pensionretirement income taxable to Maine. Military retirement pay is exempt beginning Jan.

The 10000 must be. Your military retirement is fully exempt from Maine state income tax. For the other pension income you get a maximum exclusion of 10000 each.

Maine allows for a deduction of up to 10000 per year on pension income. Increased the exemption on income from the state teachers retirement system from 25 to 50. Maine does not tax military retired pay.

First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Benefit Payment and Tax Information. Arizonas exemption is even lower 2500.

454 for income above 150000 individuals or 300000 married filing jointly. If you are retired and no longer working the income tax shouldnt affect you. Ad Its Time For A New Conversation About Your Retirement Priorities.

So you can deduct that amount when calculating what you owe in. However that deduction is reduced in an amount equal to your annual Social. June 6 2019 239 AM.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who. The good news is this may not impact you directly. Highest marginal tax rate.

Incometax2020 Itr Income Tax Tax Refund Tax Services

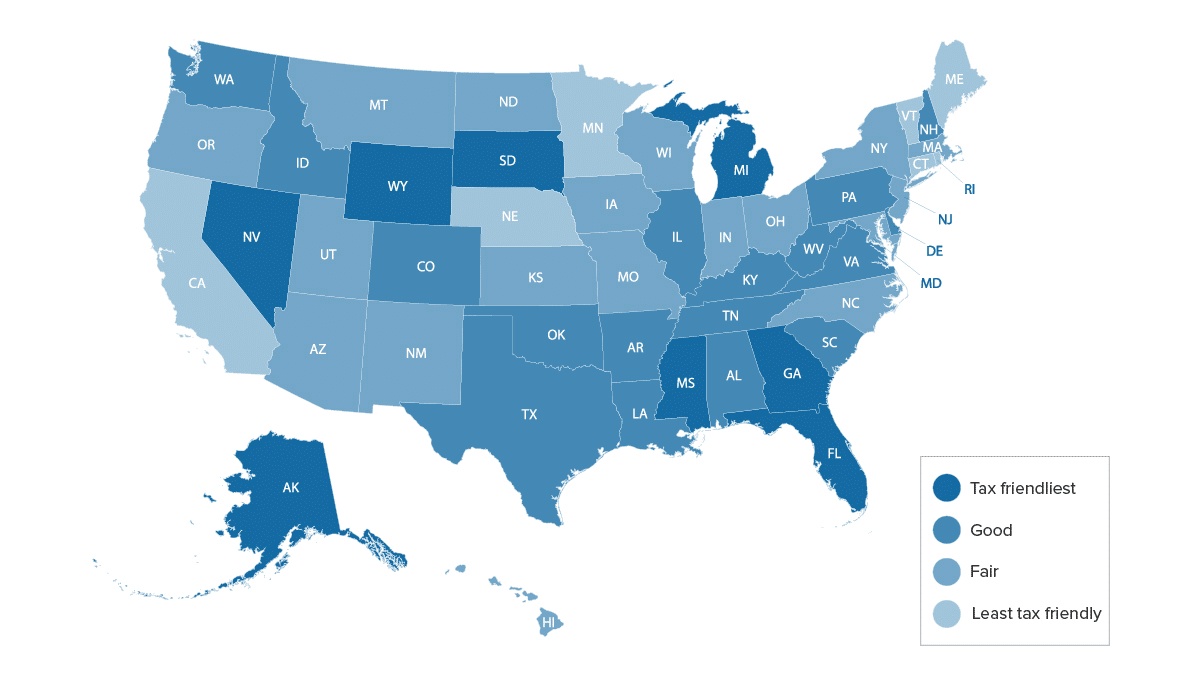

Retiring These States Won T Tax Your Distributions

Maine Retirement Tax Friendliness Smartasset

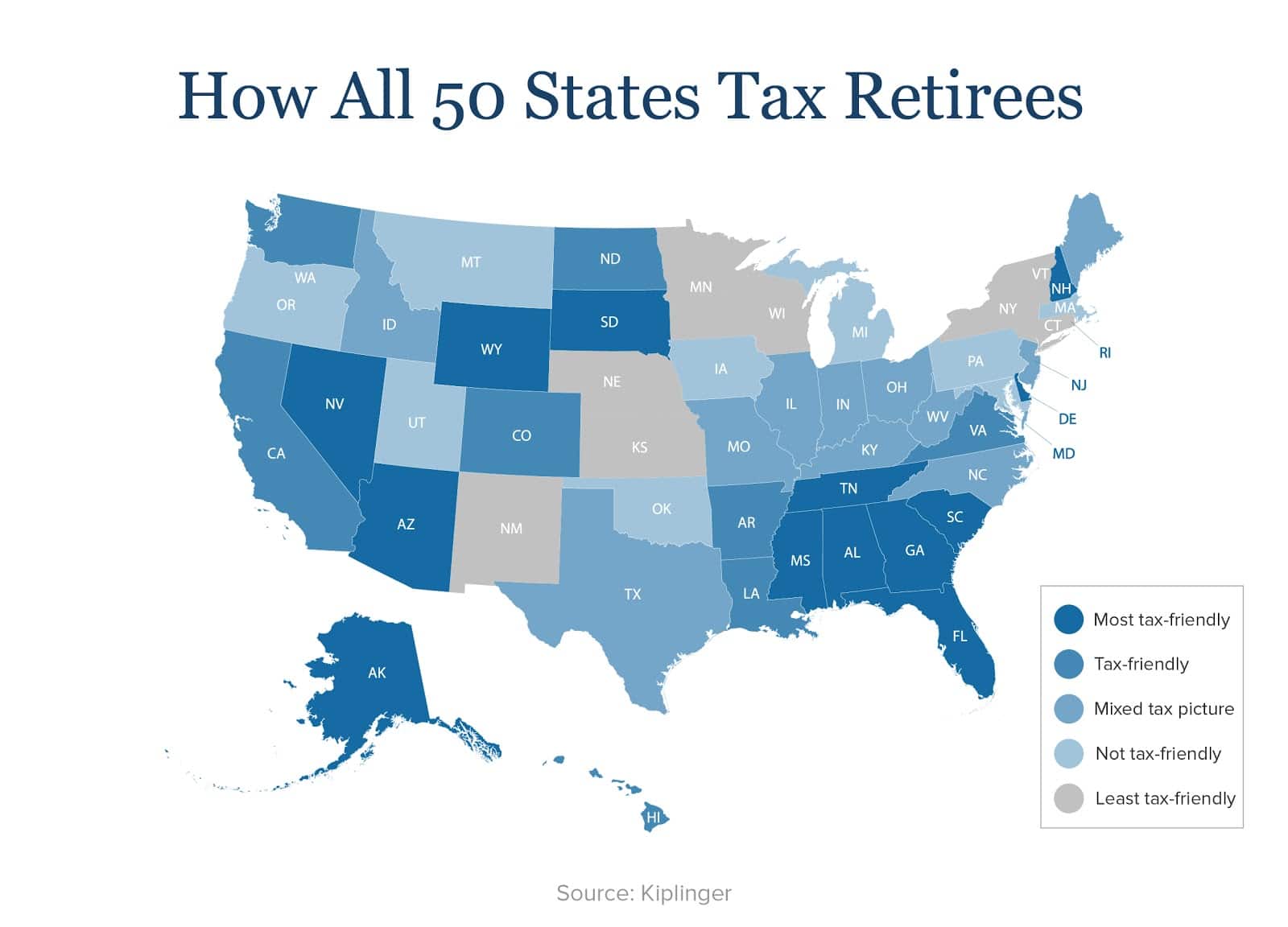

Most Tax Friendly States For Retirees Ranked Goodlife

Bitcoin Taxes In 2021 A Guide To Tax Rules For Cryptocurrency Nerdwallet Saving For Retirement Income Bitcoin

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio

7 States That Do Not Tax Retirement Income

Retiring These States Won T Tax Your Distributions

States That Don T Tax Retirement Income Personal Capital

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Maine Retirement Taxes And Economic Factors To Consider

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Tax Withholding For Pensions And Social Security Sensible Money

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Maine Retirement Tax Friendliness Smartasset

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Is A Critical Source Of Retirement Income Yet By 2030 The Trust That Helps Fund Benefits Diy Woodworking Woodworking Plans Retirement Income

The Harsh Reality For People With Disabilities Work And Struggle To Afford Medicine Or Stay Home And Struggle To Live Is Disability How To Apply Incentive